Publicado enFinance

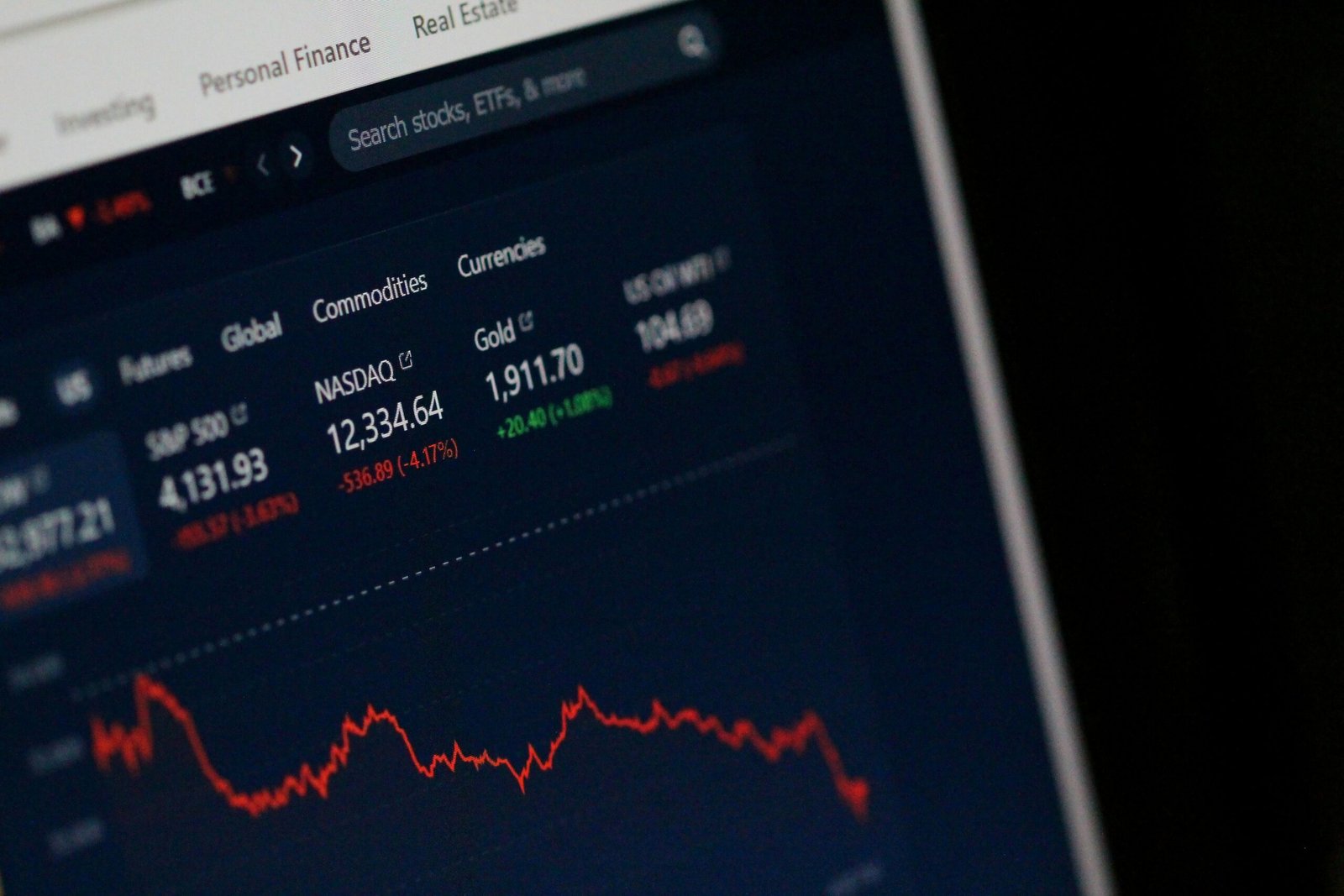

The Future of Tech Stocks: Should You Invest in AI, Blockchain, and Renewable Energy?

Introduction to Tech Stocks Tech stocks represent an integral component of the financial markets, characterized by companies operating within the technology sector. Historically, these stocks have exhibited remarkable growth, significantly…