Introduction to Investing

Many people believe that investing requires large amounts of money. However, starting with just $100 is entirely possible and can be a fantastic introductory step into the world of finance. In this guide, we’ll explore beginner strategies for investing that anyone can adopt.

Choosing the Right Investment Platform

The first step to investing with $100 is selecting an appropriate investment platform. Several online brokerages and apps cater specifically to beginners, offering low fees and user-friendly interfaces. Look for platforms with no minimum deposit requirements, allowing you to dive into investing without substantial capital. Apps such as Robinhood or Acorns can be particularly helpful.

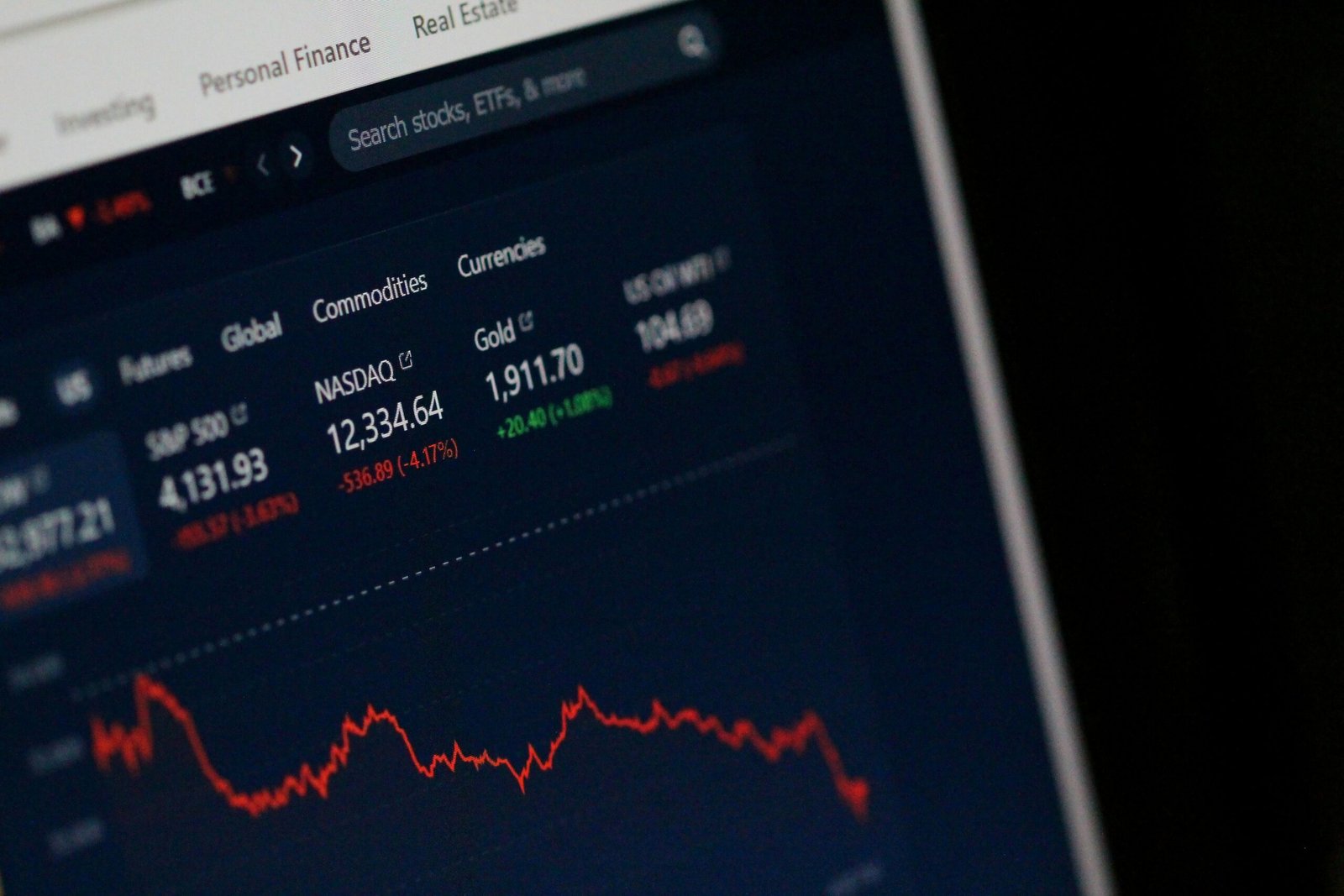

Building a Diversified Portfolio

Once you’ve chosen your platform, consider how to allocate your $100. Diversification is key in investing, even on a small scale. You can invest in fractional shares of stocks, ETFs, or even index funds that balance risk across multiple companies. A diversified portfolio helps you minimize risk and increases the potential for growth over time.

Start Small and Stay Consistent

Investing is a marathon, not a sprint. It’s important to start small and build your investments gradually. Consider setting aside a portion of your monthly budget to continue investing. Regular contributions, even if modest, can significantly impact your financial future. With time and consistency, your initial $100 investment can grow into a respectable portfolio.

Conclusion

Starting your investment journey with just $100 is achievable with the right approach. By choosing the correct platform, diversifying your portfolio, and committing to consistent contributions, you’re setting a strong foundation for future financial success. Don’t let the initial amount deter you—begin today and watch your investments flourish!