Introduction to Investing Strategies

Investing is a critical component of wealth accumulation and financial planning, encompassing various strategies to aid investors in achieving their financial goals. Among the most common strategies are active and passive investing, each designated by different principles and methodologies. Understanding these approaches provides insight into investment outcomes and helps in making informed decisions pertinent to financial objectives.

Active investing involves a hands-on approach, where investors or fund managers continually make decisions to buy, hold, or sell securities in hopes of outperforming the market. This strategy often requires thorough research, market analysis, and the anticipation of market trends. The core principle is to capitalize on short-term price movements, necessitating an in-depth understanding of individual assets and market dynamics. Active investing has been traditionally favored by those seeking to grasp immediate opportunities for capital gains, and its relevance persists amid shifting market conditions.

On the other hand, passive investing aims to mirror the performance of a market index, often through index funds or exchange-traded funds (ETFs). This strategy is predicated on the belief that, over the long term, it is difficult to consistently beat the market through active management. Passive investors typically adopt a buy-and-hold approach, resulting in lower trading costs and fees compared to their active counterparts. The growing popularity of passive investing can be attributed to its cost-effectiveness and the increasing awareness of the long-term benefits associated with market exposure.

In recent years, both strategies have evolved in response to the changing financial landscape, influenced by technological advancements and the proliferation of investment options. As investors gain access to a wealth of information, their preferences are shaped by the trade-offs and potential outcomes presented by each investing method. This overview of active and passive investing sets the stage for a detailed exploration of their respective advantages and disadvantages, which will help inform individual investment decisions.

Understanding Active Investing

Active investing is a strategy that focuses on generating higher returns than the broader market through the careful selection and management of investment assets. This approach requires investors or professional managers to actively make investment decisions based on thorough research, market trends, and individual stock performance. The primary goal is to outperform market benchmarks, such as the S&P 500, by capitalizing on opportunities that may arise due to market inefficiencies or behavioral biases.

Active investors utilize various methodologies to identify potentially profitable investments. They often engage in fundamental analysis, which examines financial statements, industry conditions, and economic indicators to assess the intrinsic value of stocks. In contrast, technical analysis focuses on price movements and volume trends to predict future performance based on historical patterns. By employing these methods, active investors aim to buy undervalued stocks while selling those that are overvalued, adjusting their portfolios dynamically as the market evolves.

To illustrate the concept of active investing, consider hedge funds, which are one of the most prominent examples of this strategy. Hedge fund managers actively seek to generate significant returns by employing diverse tactics, including leveraging, short selling, and derivatives trading. Moreover, mutual funds also exemplify active management, where fund managers continuously analyze and select a range of securities with the intent of surpassing a specific benchmark. Such strategies entail higher transaction costs and management fees compared to their passive counterparts, reflecting the intensive effort put into conducting research and executing trades.

Overall, active investing embodies a commitment to thorough analysis and responsive strategy adjustments. By embracing various disciplines and applying expertise, active investors strive to navigate the complexities of the market, pursuing returns that consistently exceed those of a passive approach.

Advantages of Active Investing

Active investing is an investment strategy that involves ongoing buying and selling actions by the investor or the investment manager to outperform market averages. One of the primary advantages of active investing is the potential to achieve higher returns than what is generally anticipated in passive investment strategies. Active investors research and analyze market trends, economic indicators, and individual securities, which allows them to identify underpriced stocks or market inefficiencies. This ability often leads to better performance in volatile or rapidly changing markets.

Furthermore, active investing offers the advantage of agility, enabling investors to respond quickly to sudden economic changes or unforeseen events. For instance, during periods of market volatility, active investors can move their holdings into more stable assets or sectors that may experience growth. This flexible approach allows for a more robust strategy during uncertain times, which is not always possible with passive investing methods that typically adhere to a set index.

Real-life examples of successful active investors also highlight the benefits of this strategy. Prominent investors like Warren Buffett and Peter Lynch have demonstrated the potential for active investing to yield substantial returns. Buffett, known for his fundamental analysis approach, often identifies undervalued companies with great potential, skillfully capitalizing on opportunities that align with his investment philosophy. similarly, Lynch employed an investment technique that focused on understanding the unique characteristics of companies, allowing him to achieve remarkable average annual returns during his tenure as a mutual fund manager.

Ultimately, active investing can provide strategic advantages that cater to not only higher returns but also adaptability in changing markets. Players in the active investing arena benefit from their experience, market knowledge, and the ability to make decisions informed by current economic landscapes.

Disadvantages of Active Investing

Active investing involves a hands-on approach to portfolio management, where investment decisions are made based on thorough analysis, market conditions, and economic trends. However, this strategy is not without its disadvantages. One of the most significant drawbacks is the higher fees associated with active management strategies. Investors often face management fees, trader commissions, and other costs that can substantially erode returns over time. These expenses can add up quickly, making it challenging for active funds to outperform their benchmarks after fees are accounted for.

Furthermore, active investing tends to be more complex compared to passive strategies. Investors must possess a deep understanding of financial markets and be willing to conduct rigorous research to identify opportunities. This level of involvement can be daunting and may require significant time and resources that many investors simply do not possess. As a result, maintaining an active investing strategy can become burdensome and may lead to poor decision-making under pressure.

The risk of underperformance also looms large in the realm of active investing. Numerous empirical studies have shown that a significant percentage of active managers fail to exceed their benchmark returns over extended periods. Market efficienc is a substantial challenge, as it suggests that it is incredibly difficult for active managers to consistently identify mispriced assets. Additionally, the emotional toll that can arise from active trading strategies can significantly impact investor behavior. Emotional decision-making can lead to impulsive trades and result in losses that may further compound financial setbacks.

In exploring the drawbacks of active investing, it becomes evident that while the potential for higher returns exists, it is accompanied by several challenges that warrant careful consideration.

Understanding Passive Investing

Passive investing is a strategy aimed at achieving market returns through minimal trading and a buy-and-hold philosophy. Unlike active investing, where fund managers attempt to outperform market indices through frequent buying and selling, passive investors focus on replicating the performance of a specific market index. This approach is based on the belief that it is challenging to consistently beat the market, and therefore, a more prudent strategy is to invest in a way that mirrors the market’s performance over time.

At the core of passive investing are vehicles such as index funds and exchange-traded funds (ETFs). An index fund, for example, is designed to follow a particular index, such as the S&P 500 or the Dow Jones Industrial Average, by investing in the same stocks that comprise that index in the same proportions. ETFs also track market indices but offer additional flexibility, such as the ability to be traded like stocks throughout the trading day. Both types of investment options provide low management fees and expense ratios, which are significant advantages when aiming for long-term growth.

The philosophy behind passive investing stems from the efficient market hypothesis, which posits that stock prices reflect all available information. As a result, it suggests that consistently beating the market is improbable for the average investor. By adopting a buy-and-hold mentality, passive investors aim for steady returns over time, minimizing the impact of market volatility. This strategy is not without its risks, but for many, it represents a reliable and less stressful way to build wealth over the long term.

Advantages of Passive Investing

Passive investing has gained popularity among investors for various compelling reasons. One of the foremost advantages is the significantly lower fees associated with passive investment strategies compared to their active counterparts. Traditional active funds often charge high management fees due to frequent trading and comprehensive market analysis, which can erode returns over time. In contrast, passive funds, such as index funds or exchange-traded funds (ETFs), typically have lower expense ratios, allowing investors to retain a larger portion of their earnings.

Another benefit is the reduced trading costs that passive investing entails. Since these strategies involve less buying and selling, investors incur lower transaction fees. This cost-efficiency becomes increasingly crucial over long investment horizons, where accumulated savings from minimal cost may lead to a substantial difference in overall returns. Moreover, passive funds aim to replicate the performance of market indices rather than trying to outperform them, making them a more straightforward investment approach.

The ease of strategy implementation is yet another attractive potential advantage of passive investing. Investors can buy and hold a diversified portfolio without the constant need for research or market timing. This simplicity not only appeals to novice investors but also offers a hassle-free experience for seasoned investors looking to minimize portfolio management responsibilities. According to various studies, passive investing has demonstrated the potential to deliver market-matching returns consistently. Research shows that the majority of actively managed funds fail to outperform their benchmark indexes over extended periods, highlighting the effectiveness of a passive approach.

Furthermore, passive investing typically generates less stress for long-term investors as it eliminates the emotional strain of attempting to time the market. With its focus on long-term growth rather than short-term market fluctuations, passive investing aligns well with a disciplined investment philosophy. Investors can thus concentrate on their goals without constantly worrying about market volatility.

Disadvantages of Passive Investing

Passive investing, while designed to replicate market performance, has several limitations that investors should consider. One of the most significant drawbacks is the potential to miss out on greater returns during strong bull markets. Passive strategies, which typically rely on following index benchmarks, may not capitalize on opportunities that active managers exploit. As a result, investors may find themselves with below-average returns compared to their actively managed counterparts, particularly in rising markets.

Another limitation of passive investing is its inherent inflexibility. In a rapidly changing financial landscape, the inability to adapt to market conditions can be detrimental. Passive investments automatically replicate index performance without adjusting for prevailing economic conditions or shifts in market sentiment. This could lead to suboptimal outcomes, particularly during periods of volatility or when sectors within an index are underperforming.

Moreover, passive investors may experience significant underperformance during market downturns. While market declines impact all types of investments, a passive strategy locked into an index could suffer heavier losses without the protective measures that active managers might employ. This ‘set-it-and-forget-it’ approach can be particularly hazardous in turbulent markets, where active strategies could offer better downside protection and more strategic asset allocation.

Lastly, an over-reliance on passive investing can also foster complacency among investors. Without regular review and strategic adjustments to their portfolios, investors might neglect important changes that could enhance their investment outcomes. This mindset could lead to missed opportunities not only in bull markets but also in emerging sectors that are not included in traditional indices. Balancing passive investing approaches with a thorough understanding of market dynamics is essential to mitigate these risks and optimize financial growth.

Comparative Analysis: Active vs. Passive Investing

Active and passive investing are two prominent strategies that investors consider when managing their portfolios. Each approach has unique characteristics that influence its performance, costs, risks, and overall investor behavior. Understanding these differences is crucial for making informed investment decisions.

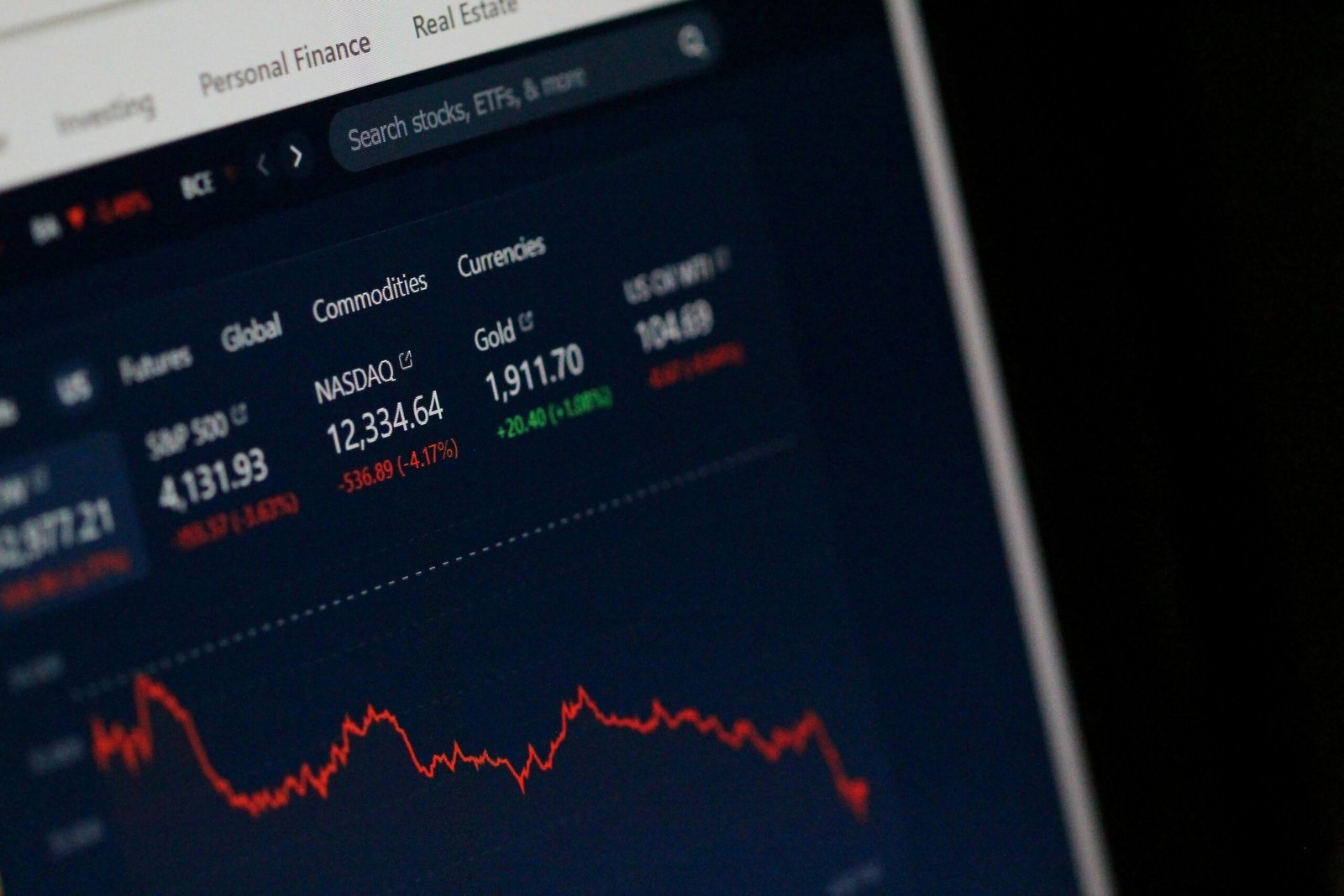

One of the primary distinctions between active and passive investing lies in performance metrics. Active investing involves frequent trading and stock selection by portfolio managers, aiming to outperform a specific benchmark. This approach can potentially yield higher returns, especially during volatile market conditions when active managers can capitalize on price fluctuations. Conversely, passive investing mirrors the performance of a particular index, such as the S&P 500, which generally leads to lower returns relative to outstanding active funds. However, during strong bull markets, passive strategies often perform comparably well, as stock prices tend to rise uniformly.

Cost is another significant factor distinguishing the two methodologies. Active funds typically incur higher fees due to the extensive research and management required to make investment decisions. These elevated costs can erode returns over time, making it critical for investors to assess whether the potential for outperformance justifies the additional expense. On the other hand, passive investing typically features lower management fees and trading costs, as it involves a more straightforward buy-and-hold approach. Research has consistently shown that over the long term, many active managers fail to beat their benchmarks after accounting for fees.

Turning to risk factors, active investing is often perceived as riskier due to its reliance on market timing and stock selection. Successful active managers can generate significant returns, but there is always the possibility of underperformance, particularly in challenging market environments. Passive investing provides a more defensive strategy, diversifying risk across various sectors as it follows the movements of an entire index.

The behavior of investors plays a crucial role as well. Active investors tend to be more involved in market analysis and timing decisions, possibly leading to emotional trading based on market sentiments. In contrast, passive investors might adopt a longer-term approach, focusing on their overall financial goals rather than short-term market fluctuations.

Conclusion: Choosing the Right Investment Strategy

In the ongoing debate between active and passive investing, both strategies present distinct advantages and limitations that investors must carefully evaluate. Active investing allows for increased flexibility and the opportunity to capitalize on market inefficiencies, potentially leading to higher returns. However, it typically involves higher fees and requires significant time and expertise. On the other hand, passive investing provides a more stable, low-cost approach by tracking market indices, offering investors ease of management and diversification. The trade-off, however, is the limited ability to outperform the market.

When determining the most suitable investment strategy, investors should consider their personal objectives, risk tolerance, and time horizons. Individuals aiming for long-term growth with minimal engagement may find passive strategies particularly appealing, as they require less frequent trading and can position capital for appreciation over time. Conversely, those with a higher risk tolerance and a willingness to engage actively in the market might gravitate towards active investing to attempt achieving superior returns.

Moreover, investors should recognize that a blended approach, incorporating both active and passive elements, can be a viable solution. Such a hybrid strategy enables diversification of investments while also allowing for the potential of capitalizing on market volatility through active management. This balance could lead to a more robust investment portfolio tailored to individual circumstances.

Ultimately, continuous education and adaptation play a pivotal role in investment success. By staying informed about market trends, economic changes, and shifts in personal financial goals, investors can dynamically adjust their strategies to meet their evolving needs. The investment landscape is ever-changing, and the most successful investors will be those who remain agile, informed, and open to refining their approaches over time.

“What are the key differences between active and passive investing strategies in terms of risk and return?”

Investing is essential for building wealth, and the choice between active and passive strategies can significantly impact financial outcomes. Active investing demands constant market analysis and aims to outperform the market, while passive investing focuses on matching market returns with lower costs. Both methods have their merits, and the decision often depends on an investor’s goals and risk tolerance. As technology continues to shape the financial landscape, how can investors best adapt their strategies to stay aligned with their long-term objectives?

Investing is essential for building wealth and achieving financial goals, with active and passive strategies offering distinct approaches. Active investing focuses on short-term gains through frequent trades and market analysis, while passive investing aims for long-term growth by mirroring market indices. Both methods have their benefits, depending on an investor’s goals and risk tolerance. The choice between them often hinges on whether one prefers hands-on management or a more cost-effective, steady approach. Which strategy aligns better with today’s dynamic market conditions?