Introduction

In an era where financial literacy is becoming increasingly vital, individuals are actively seeking investment avenues that offer the potential for sustainable long-term growth. Among various options, the stock market and real estate have emerged as prominent choices, each with its unique characteristics and variations in risk and return. As investors become more sophisticated in their approaches to wealth accumulation, a comparative analysis of these two investment vehicles has garnered significant attention.

The motivation behind comparing stock market investments with real estate stems from a desire to understand the most effective strategies for maximizing returns. While the stock market is known for its liquidity and growth potential, real estate is often lauded for its stability and consistent income generation through rentals. This dichotomy invites a closer examination of both avenues, allowing prospective investors to make informed decisions aligned with their financial goals and risk tolerance.

Furthermore, the rising interest in personal finance among the general population emphasizes the need for clarity regarding different investment strategies. As more individuals look to diversify their portfolios, the choice between investing in the stock market or real estate becomes paramount. Understanding the factors influencing potential returns, including market conditions, economic trends, and individual circumstances, is essential for developing a comprehensive investment strategy.

Ultimately, this blog post aims to dissect the complexities of stock market and real estate investment, exploring their respective advantages and disadvantages. By providing a nuanced perspective on the long-term returns associated with each asset class, readers will be better equipped to navigate their investment journeys and make decisions that could significantly impact their financial futures.

Understanding Stock Market Investments

The stock market serves as a platform for trading ownership shares in publicly listed companies, often referred to as stocks. When investors purchase stocks, they acquire a stake in a company, potentially benefiting from both dividends and capital appreciation. Dividends, which are portions of a company’s profit returned to shareholders, can provide a consistent income stream, while capital gains occur when the value of a stock increases over time. Investors are drawn to stocks because of their historical performance, which shows a general upward trend in value over extended periods.

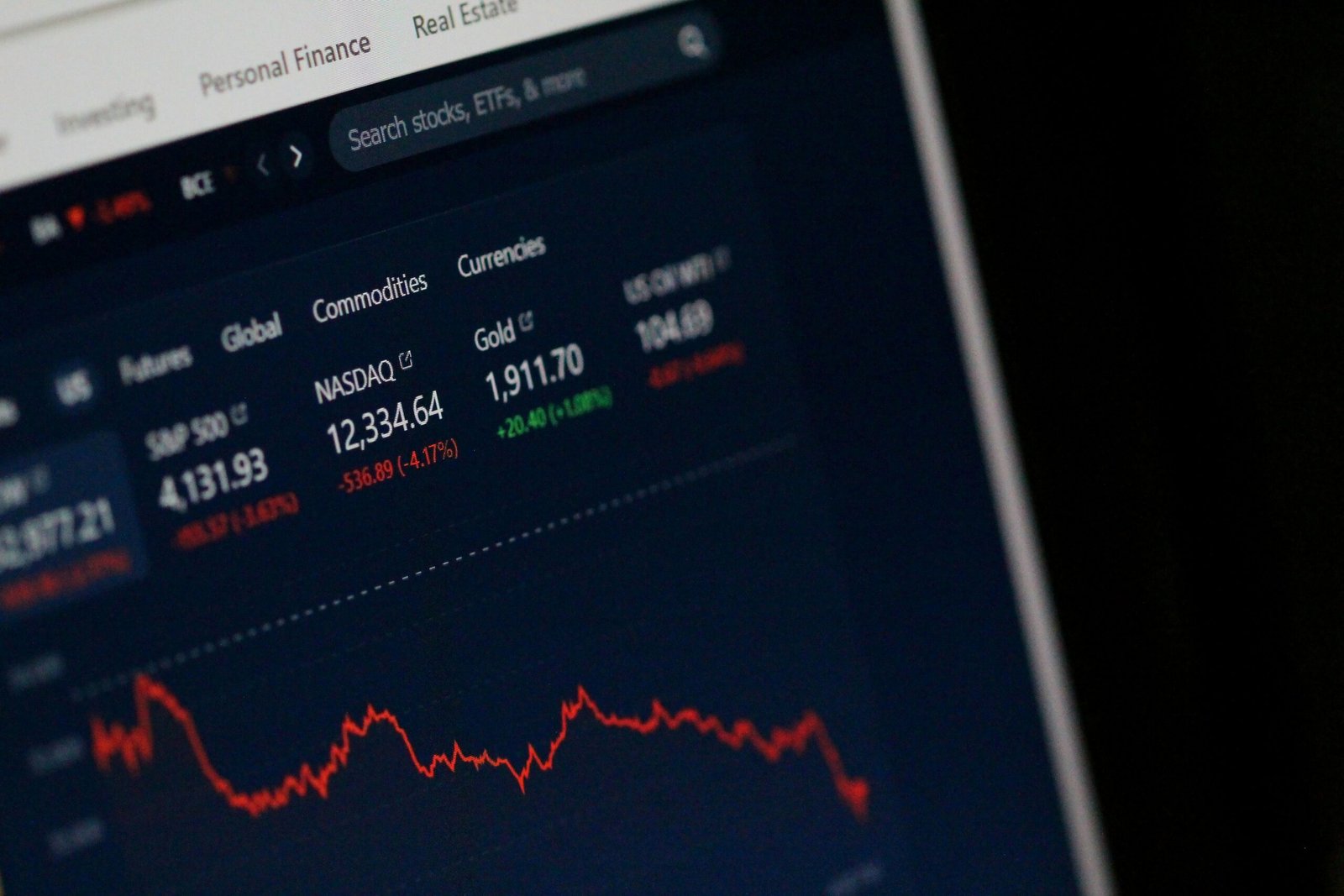

Market indices like the S&P 500 and the Dow Jones Industrial Average are used to gauge the overall performance of the stock market. These indices aggregate the performance of a basket of selected stocks, providing insights into market trends and economic health. Investors may analyze these trends to inform their trading strategies, helping them make decisions based on current market conditions and potential future performance.

The stock market also exposes investors to economic fluctuations. Company valuations can be significantly impacted by macroeconomic factors such as interest rates, inflation, and geopolitical events. These factors can lead to volatility, resulting in abrupt price changes for stocks. However, this volatility also presents opportunities for savvy investors to capitalize on market dips for potential long-term gains.

Liquidity is a notable feature of stock investments, enabling individuals to buy or sell shares quickly and easily. This characteristic is particularly appealing compared to other investment forms, as it allows investors to adjust their portfolios in response to changing market conditions. Overall, while the stock market offers significant potential for returns, it requires a thorough understanding of the underlying principles and diligent research to navigate effectively.

Understanding Real Estate Investments

Real estate investing is an established method for building wealth and ensuring long-term financial security. This type of investment can be broadly categorized into various types, such as residential and commercial real estate. Residential real estate includes single-family homes, multi-family apartments, and condominiums, primarily intended for people to live in. On the other hand, commercial real estate consists of properties used for business purposes, including office buildings, retail spaces, and warehouses. Each type of real estate comes with its unique set of factors, opportunities, and risks.

The mechanics behind how real estate investments generate returns are multifaceted. One significant source of income is rent, which can provide a consistent cash flow for property owners. This rental income is often considered a reliable stream of revenue as long as the property is well-maintained and located in a desirable area. Additionally, appreciation represents another crucial aspect of real estate returns. Over time, properties typically increase in value, benefiting investors who aim to sell in the future at a profit. Market conditions, location, and property improvements all influence this appreciation, making location a paramount factor in real estate investment success.

Beyond rental income and appreciation, real estate investments offer valuable tax benefits. Property owners can deduct mortgage interest, property depreciation, and various expenses related to managing and maintaining the property. These deductions can significantly reduce an investor’s taxable income, providing additional financial advantages. Moreover, the tangible nature of real estate differentiates it from more volatile investments, such as stocks. Investors often feel a greater sense of security owning a physical asset, as opposed to holding shares in a company. This tangible aspect can enhance the long-term appeal of real estate as an investment choice.

Risk Assessment: Stock Market vs. Real Estate

When evaluating investment opportunities, understanding the risk factors associated with different assets is essential. The stock market is often characterized by its inherent volatility, influenced by economic indicators, market sentiment, and geopolitical events. Prices of stocks can fluctuate dramatically within short periods, resulting in a rollercoaster of gains and losses for investors. This rapid movement may present lucrative opportunities for those who can navigate market trends, but it also imposes a higher risk for individuals with lower risk tolerance.

In contrast, real estate investments typically exhibit a more stable growth pattern. Real estate values do increase and decrease, but the fluctuations are generally less pronounced compared to stocks. This steadier nature of real estate provides a sense of security for investors, as properties tend to appreciate over time, often becoming an effective hedge against inflation. However, real estate markets are not immune to economic downturns. In recessions, property values can decline, resulting in reduced rental income and increased vacancy rates. Thus, while real estate may appear less risky, it still faces its own set of challenges that can impact overall returns.

Another key aspect to consider in risk assessment is diversification. In the stock market, investors can mitigate risks by diversifying their portfolios across various sectors and asset types. Diversification allows investors to reduce exposure to any single investment and potentially buffer against sudden market downturns. Similarly, real estate investors can diversify by investing in different property types, geographic locations, or real estate investment trusts (REITs). This approach not only spreads risk but can also enhance overall returns over the long term as various markets perform differently under changing economic conditions.

Liquidity and Accessibility

When comparing investments, liquidity refers to how easily and quickly an asset can be converted into cash. In this regard, the stock market typically offers higher liquidity than real estate. Stocks can be bought and sold within minutes during market hours, allowing investors to access their funds rapidly. This immediacy is crucial, particularly for those who may need to mobilize their capital quickly in response to market changes or personal financial needs.

On the contrary, real estate investments involve longer time frames for liquidity. Selling a property can take weeks or even months, as it includes processes such as listing the property, marketing it, negotiating offers, and eventually closing the sale. This extended duration may pose challenges for investors looking to quickly liquidate their assets. Additionally, real estate transactions often incur significant costs, which further diminish the immediacy of accessing cash.

Accessibility also plays a critical role in the investment landscape. The stock market is generally more accessible to the average investor because it often requires a lower initial capital investment. With many brokerage accounts allowing for the purchase of partial shares, individuals can begin investing with relatively modest amounts. Furthermore, technology has made stock trading highly accessible through online platforms and mobile applications, enabling anyone with internet access to participate.

Conversely, the barriers to entry in real estate are notably higher. Investors typically need substantial capital for down payments, closing costs, and potential renovations. Moreover, ownership entails ongoing expenses such as property taxes and maintenance costs, which can deter potential investors. The complexities associated with property management and the need for specialized knowledge to navigate the real estate market can further limit accessibility for the average individual.

Potential Returns: A Comparative Analysis

When considering long-term investments, the potential returns generated by the stock market and real estate are essential factors to assess. Historically, the stock market has provided an average annual return of approximately 7% to 10%, after adjusting for inflation. This figure can vary significantly based on market conditions and individual securities chosen. In contrast, real estate tends to yield an average annual return of about 8% to 12%, considering property appreciation and rental income. These percentages suggest comparable returns; however, investors should consider other factors that could impact overall profit.

To further analyze the differences, one must account for expenses associated with real estate investments. These can include property taxes, maintenance costs, management fees, and mortgage interest. After deducting these costs, net returns for real estate may range from 6% to 10% annually. Conversely, stock market investments generally incur lower transaction costs and fees, particularly when utilizing low-cost index funds or exchange-traded funds (ETFs). This difference can make stock market investments more appealing for cost-conscious investors.

Moreover, growth potential plays a crucial role in determining which investment yields better long-term returns. For instance, the stock market has historically seen periods of rapid growth, particularly in sectors poised for technological advancements. Experts suggest that certain industries, such as clean energy and technology, are projected to continue flourishing. On the other hand, real estate benefits from location-driven appreciation, which can be highly lucrative in metropolitan areas experiencing population growth. Analysts predict that urbanization trends will enhance real estate demand for years to come.

Ultimately, both investment types have their merits and pitfalls depending on individual circumstances, risk tolerance, and investment strategy. The decision may hinge not just on potential returns but also on an investor’s preference for risk and their financial goals.

Tax Implications of Each Investment Type

Investing in the stock market and real estate involves navigating various tax implications that can significantly impact overall returns. One of the primary factors to consider is the capital gains tax, which applies to both investment types, albeit in different ways. For stocks, the capital gains tax is incurred when the investor sells a stock at a higher price than the purchase price. The rate at which an investor is taxed on gains can depend on how long the stock has been held; short-term gains are taxed as ordinary income, whereas long-term capital gains benefit from lower tax rates.

On the other hand, real estate investments are also subject to capital gains tax but come with additional benefits. For instance, real estate investors typically benefit from depreciation, a tax advantage that allows them to deduct the cost of property improvements and wear and tear over time. This tax deduction can significantly reduce taxable income, making real estate investments more appealing for long-term wealth accumulation.

Moreover, real estate investors can utilize 1031 exchanges, which allow for the deferral of capital gains tax when selling one property and purchasing another of equal or greater value. This mechanism provides a substantial tax incentive, enabling investors to reinvest their gains instead of paying taxes immediately, thereby enhancing long-term returns.

In contrast, the stock market does not offer a similar mechanism for tax deferral. Instead, dividends received from stocks are taxed as income in the year they are earned, which can affect cash flows for investors. Additionally, property taxes are an ongoing obligation for real estate investors, whereas stock market investors typically do not encounter such recurring costs. Evaluating these tax implications plays a crucial role in determining which investment yields better long-term returns.

Diversification: Balancing Your Portfolio

Diversification is a fundamental investment strategy that mitigates risk by spreading investments across various asset classes. When it comes to balancing a portfolio between stocks and real estate, this approach becomes particularly significant. Each asset class comes with its own set of risks and rewards, and by investing in both, an investor can buffer against the inherent volatility of the stock market while reaping the benefits of real estate investments.

Investing in stocks offers the potential for higher short-term returns, but it also poses risks such as market fluctuations and economic downturns. Conversely, real estate typically appreciates over the long term, providing a measure of stability. However, it is subject to different risks, including property market cycles, changes in interest rates, and the costs associated with property maintenance. By maintaining a diversified investment portfolio that includes both stocks and real estate, investors can effectively hedge against these unique risks.

Effective strategies for balancing investments involve assessing risk tolerance, investment goals, and time horizons. For instance, risk-averse investors may lean more towards real estate, which generally offers consistent income through rental yields and a more predictable appreciation trajectory. On the other hand, those seeking higher growth may prefer to allocate a larger portion of their portfolio into stocks. A well-structured strategy might include periodic rebalancing, ensuring that an investor’s asset allocation remains aligned with their objectives, especially as market conditions change.

Therefore, the key to a successful investment portfolio lies in recognizing the importance of diversification. By integrating both stocks and real estate, investors can not only reduce overall risk but also increase the likelihood of achieving superior long-term returns. Balancing these investments allows for adaptability and resilience in the face of market fluctuations, underscoring the value of a diversified approach to investing.

Conclusion: Making the Right Choice for You

The decision between investing in the stock market or real estate is multifaceted and heavily influenced by personal financial goals, risk tolerance, and prevailing market conditions. Throughout this discussion, we have highlighted the distinct characteristics and potential returns associated with both investment avenues. The stock market is generally recognized for its liquidity and potential for high short-term gains, making it attractive for investors who are comfortable with volatility. Conversely, real estate is often deemed a stable investment, providing steady cash flow and potential appreciation over time, appealing to those who prefer a tangible asset and less market fluctuation.

Evaluating one’s risk tolerance is paramount in making an informed choice. Individuals who are risk-averse may find real estate to be a safer option, as it tends to yield consistent returns despite market downturns. On the other hand, investors with a higher risk appetite might prefer the stock market, given its potential for substantial gains alongside the possibility of losses. Additionally, market conditions play a critical role; understanding economic indicators and trends can help investors determine whether it is a favorable time to enter the stock market or to invest in real estate.

Ultimately, each investor’s situation is unique, and it is essential to weigh the advantages and drawbacks of each option thoroughly. Diversification may also serve as a prudent strategy, allowing investors to mitigate risks associated with either asset class. By considering personal circumstances and aligning them with investment objectives, individuals can make a more tailored decision that serves their long-term financial aspirations. Careful assessment will lead to a more confident choice between stock market investments and real estate opportunities, ensuring that the path chosen is right for them.